- About company

-

AreasThe field of metallurgy and mining Automotive and transportation services Biotechnology and medicine Real Estate and Construction Oil and gas industry Household products Activity of mobile operators The scope of state and government institutions New technologies Electricity and fuel and energy complex Finance

-

Services

- Offshore company registration

-

Offshore Jurisdictions

- Company registration Anguilla

- Company registration in Antigua

- Offshore company Aruba

- Offshore company Bahamas

- Offshore company Barbados

- Company registration British Virgin Islands

- Offshore company in Vanuatu

- Offshore company Gibraltar

- Company registration in Hong Kong

- Company registration on Jersey

- Company registration in the Caymans

- Company registration in Costa Rica

- Company registration in Curacao

- Company registration in Labuan

- Company registration in Liberia

- Company registration in Mauritius

- Company registration in Madeira in 2023

- Company registration in Macau

- Company registration in Malta

- Offshore company registration in the Marshall Islands

- Company registration in Monaco

- Company registration in Nauru

- Company registration in St. Kitts

- Company registration in Niue

- Company registration in the Isle of Man

- Company registration in the Cook Islands

- Company registration Panama

- Company registration in Samoa

- Company registration in San Marino

- Company registration in Sark

- Company registration in Singapore

- Company registration in Turks & Caicos

-

Low-Taxed Jurisdictions

- Company registration in Malta

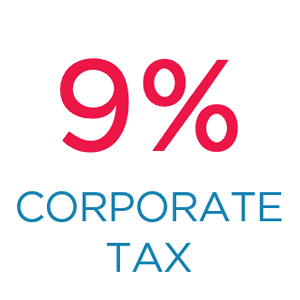

- Registration of companies in Cyprus

- Company registration in Germany

- Company registration in Poland

- Company registration in Switzerland

- Company registration in Lithuania

- Company registration in Ireland

- Company registration in Hungary

- Company registration Delaware

- Company registration in Portugal

- Company registration in Romania

- Company registration in Slovakia

- Company registration in Slovenia

- Company registration in Luxembourg

- Company registration in New Zealand

-

European Jurisdictions

- Company registration in Albania

- How to registrate company in Andorra

- Company registration in Belgium

- Registration of a company in Bulgaria

- Company registration in Germany

- Company registration in Hungary

- Offshore company Gibraltar

- Company registration in Greece

- Company registration in Denmark

- Company registration on Jersey

- Company registration in Ireland

- Company registration in Iceland

- Company registration in Italy

- Registration of companies in Cyprus

- Company registration in Lithuania

- Company registration in Luxembourg

- Company registration in Macedonia

- Company registration in Malta

- Company registration in Monaco

- Company registration in the Netherlands

- Company registration in Norway

- Company registration in the Isle of Man

- Company registration in Poland

- Company registration in Portugal

- Company registration in Romania

- Company registration in San Marino

- Company registration in Sark

- Company registration in Serbia

- Company registration in Slovakia

- Company registration in Slovenia

- Company registration in Spain

- Company registration in Ukraine

- Company registration in France

- Company registration in Croatia

- Company registration in Montenegro

- Company registration in Czech Republic

- Company registration in Switzerland

- Company registration in Sweden

- Company registration in Estonia

- Company registration in Georgia

-

Jurisdictions in Asia

- Company registration in Bangladesh

- Company registration in Bahrain

- Company registration in Brunei

- Company registration in Hong Kong

- Company registration in Israel

- Company registration in India

- Company registration in China

- Company registration in Labuan

- Company registration in Lebanon

- Company registration in Macau

- Company registration in UAE

- Company registration in Singapore

- Company registration in Thailand

- Company registration in Turkey

- Company registration in Armenia

-

Jurisdictions in North and South America

- Company registration in Canada

- Company registration Anguilla

- Company registration in Antigua

- Company registration in Argentina

- Offshore company Aruba

- Offshore company Bahamas

- Offshore company Barbados

- Company registration in Brazil

- Company registration British Virgin Islands

- Company registration in the Caymans

- Company registration in Columbia

- Company registration in Costa Rica

- Company registration in Cuba

- Company registration in Curacao

- Company registration in Peru

- Company registration in St. Kitts

- Company registration Panama

- Company registration in Saint Vincent

- Company registration in Saint Vincent

- Company registration in Turks & Caicos

- Company registration in Uruguay

- Company registration in Chile

- Company registration Delaware

- Company registration in Venezuela

- Company registration in Ecuador

- Jurisdictions for companies in Africa

- Jurisdictions for companies in Australia and Oceania

-

Offshore Jurisdictions

- Tax consulting services

- Licensing

- International Banking Licenses

-

Money transfer services, Payment processing services, Money transfer services license

- MSB License in the USA

- MSB License in Canada

- MSB license in Australia

- Register money services business (MSB) or foreign money services business (FMSB)

- License for electronic money in Estonia

- Electronic money license in UK

- EMI License in Latvia

- EMI license in Ireland

- AEMI license in Cyprus

- AEMI license in Poland

- SEMI license in Malta

- SEMI license in Lithuania

- SEMI license in UK

- AEMI license in Ireland

- EMI license in Poland

- EMI license in Cyprus

- AEMI license in Malta

- EMI license in Czech Republic

- EMI License in Lithuania

- PSP license in Mauritius

-

Forex Broker License

- Foreх broker licensе in Bulgariа

- Forex broker license in Estonia

- Vanuatu Forex Broker License

- Forex Broker License in Cyprus

- Forex Brokerage License in Seychelles

- Forex broker license in Mauritius

- Broker license in Cambodia 2023

- EMI License in New Zealand

- Forex Broker License in Cayman Islands

- Comoros Forex license

- Forex license in Brazil

- Forex Broker License in Belize

- Forex License in South Africa

- Forex license on Bahamas

-

Gambling Licenses

- Malta gambling license

- Gaming License in Cyprus

- Gaming License in Isle of Man

- Obtaining a gambling license in Austria

- Obtaining a gambling license in Belgium

- Gaming License in Gibraltar

- Olderni Gambling License

- Dominican Republic Gambling License

- Gaming License in Kahnawake

- Gaming License in Romania

- Gambling license in El Salvador

- Gaming license in Estonia

- Italy gambling license

-

Cryptocurrency Licenses

- Estonian cryptocurrency exchange license

- ICO license on Gibraltar

- Cryptocurrency License in the USA

- Crypto license in Malta

- REGISTRATION OF A CRYPTOEXCHANGE IN THE CZECH REPUBLIC

- Registration of a cryptocompany in El Salvador

- Obtaining a crypto license in DMCC (UAE)

- How to obtain a Crypto license in Abu Dhabi (UAE)

- Сrypto license in Bahrain

- Crypto license in Bulgaria

- Crypto license in Malta

- Crypto license in Romania

- Crypto license in Sweden

- Crypto license in Switzerland

- Crypto License in Dubai

- Crypto License in France

- Regulated Cryptocurrency License in Georgia for Secure Trading

- Crypto license in Slovenia

- Crypto License in Spain

- Crypto license in Philippines

- Crypto license in Cuba

- Crypto License in Portugal

- Crypto License in Poland

- Crypto License in Germany

-

Trust

- Obtain Your Trust License in Luxembourg

- Secure a Trust License in Lithuania

- Get Your Trust License in Belgium

- Obtain a Trust License in Spain

- Secure Your Trust License in Portugal

- Get a Trust License in Latvia

- Obtain Your Trust License in Sweden

- Secure a Trust License in Estonia

- Get Your Trust License in Switzerland

- Obtain a Trust License in the Cayman Islands

- Secure Your Trust License in Mauritius

- Get a Trust License in the Bahamas

- Obtain Your Trust License in Dominica

- Secure a Trust License in the Comoros

- FinTech Services

- Gambling

- Accounting services

- Corporate services

- IT Law

- Due diligence

- Registration of trademarks

- Fintech Software Development

-

Fintech Software Development

- Development of Fintech applications and services

- Electronic payment system development

- Mobile banking system development

- Development of DeFi solutions

- Development of trading robots and terminals

- Cryptocurrency exchange and exchanger development

- Issue of cryptocurrencies (tokens)

- Blockchain application development

-

Fintech Software Development

- Support IPO

- ICO consulting services

- Citizenship in Ukraine

- Opening merchant account

- Drafting contracts

- Redomicile of companies

- Trust registration

- Investment

- Investment in real estate

- Legal Opinion

- Opening a cryptocurrency debit card

Latest news

Company Liquidation in Croatia

March 6, 2025Read MoreOrganisation termination is a well-defined lawful workflow that leads to the winding-up of a business entity, guaranteeing that its monetary and legislative mandates are properly settled. Whether due to monetary hurdles, deliberate transformations, or legislative workflow, liquidating a company in Croatia demands careful abidance by local legislations and supervisions. This guide provides a detailed overview…

Opening a corporate bank account in UAE: Essential basis for you and your business

March 6, 2025Read MoreA strategic approach is necessary to navigate the country’s monetary landscape, especially when setting up an entity’s fund. The UAE’s fiscal ecosystem is dynamic and rigorously controlled, making a broad spectrum of amenities available to firms of all sizes. Understanding the complexities of the banking system is critical for ensuring a smooth monetary experience for…

Company Liquidation in France

March 6, 2025Read MoreDefining an organisation can be an overwhelming and intricate workflow, particularly at the time of navigating lawful frameworks in a foreign country. This region has a well-defined lawful structure for such a workflow, guaranteeing organisations fulfill their mandates before ceasing functioning. Understanding the various kinds of Company Liquidation in France, the demanded mechanisms, and the…

Company Liquidation in Slovenia

March 6, 2025Read MoreLiquidating a company in Slovenia is a significant step that requires a thorough apprehension of legislative mechanism, mandatories, and monetary implications. Whether due to monetary difficulties, a strategic commercial shift, or voluntary winding-up, companies ought to follow a strict legislative scheme to terminate functioning properly. This publication furnishes an in-depth look at company liquidation in…

-

Businesses for sale

- Ready-made companies for sale

- Ready-made licenses for sale

-

Crypto licenses

- Crypto License in Dubai

- Crypto license in El Salvador

- Crypto license in Lithuania 2024

- Cryptocurrency license in Czech Republic

- Crypto License in Poland

- Crypto license in Italy

- Crypto License in France

- Crypto License in Spain

- Crypto License in Portugal

- Crypto License in Germany

- Regulated Cryptocurrency License in Georgia for Secure Trading

- Slovakia crypto license

- Crypto license in Malta

- Crypto license in Seychelles

- Crypto license in Bulgaria

- Crypto license in Romania

- Crypto license in Latvia

- Crypto license in Slovenia

- Crypto license in Gibraltar

- Crypto license in Mauritius

- Crypto license in India

- Crypto License in Cyprus

- Crypto license in Antigua

- Crypto license in Sweden

-

PSP license

- PSP license in Singapore

- PSP license in Brazil

- PSP license in Mauritius

- PSP license in Poland

- PSP license in Spain

- PSP license in Cyprus

- PSP license in Ireland

- PSP license in Lithuania

- PSP license in Malta

- PSP license in Estonia

- PSP license in Latvia

- PSP license in UK

- PSP license in Cayman Islands

- PSP license in Hong Kong

- PSP license in Lithuania

- PSP license in Belgium

- PSP license in Spain

- PSP license in Portugal

- PSP license in Luxembourg

- PSP license in Latvia

- PSP license in Sweden

- PSP license in Estonia

- PSP license in Switzerland

- Forex licenses

- Offshore forex license

-

Gaming License obtaining

- Gaming License in Costa Rica

- Gaming License in Philippines

- Gaming License in Isle of Man

- Gaming License in Cyprus

- Gaming License in Malta

- Gaming License in Gibraltar

- Gaming License in Romania

- Gaming License in Belize

- Gaming License in Kahnawake

- Gaming License in UK

- Gaming License in Antigua and Barbuda

- MSB license

- SPI license

- EMI licenses

- SEMI licenses

-

Asset management licenses

- Asset management license in UK

- Asset management license in Belgium

- Asset management license in Spain

- Asset management license in Portugal

- Asset management license in Luxembourg

- Asset management license in Latvia

- Asset management license in Sweden

- Asset management license in Estonia

- Asset management license in Greece

- Asset management license in France

- Asset management license in Switzerland

- Forex broker license

- Securities dealer license

- Investment dealer licenses

-

Crypto licenses

- Banks for sale

- Ready-made cryptocurrency licenses for sale

Latest offers

Neobank Business with Multi-Currency IBAN Accounts and Crypto Trading Platform for Sale

March 6, 2025Read MoreAn exclusive opportunity to acquire a Neobank business integrated with a multi-currency IBAN solution and a cryptocurrency trading platform. This venture is part of an Approved Partner Programme from a regulated fintech company in the UK, offering a turnkey solution for launching a cutting-edge online banking and crypto exchange business. Key Features of this Neobank…

Exclusive Danish BaaS Financial & Crypto Company for Sale

March 6, 2025Read MoreWe present a prime opportunity – a fully operational Danish BaaS financial & crypto company for sale, strategically positioned within Denmark’s robust financial ecosystem. This turnkey solution is ideal for businesses seeking an established framework in banking-as-a-service, crypto operations, and cross-border financial services. Buy Danish BaaS Financial & Crypto Company BaaS financial & crypto company…

Czech VASP License for Sale

February 28, 2025Read MoreWe are excited to present an exceptional opportunity – a Czech VASP license for sale. This permit offers a solid platform for entering the rapidly growing crypto industry or expanding your business portfolio. Buy VASP License in the Czech Republic VASP license in the Czech Republic for sale, obtained in 2022, provides regulatory authorization under…

Fully Operational Securities Dealer License in Seychelles for Sale

February 20, 2025Read MoreAn exclusive opportunity to acquire a fully operational Securities Dealer License in Seychelles with an established client base, banking infrastructure, and trading platform. This is a turnkey solution for investors looking to enter or expand within the global financial markets. Key Features of This Seychelles Securities Dealer License Company Details Incorporation Year: 2020 License: Fully…

- Prices

- Contacts

- News

- About company

-

AreasBack

- The field of metallurgy and mining

- Automotive and transportation services

- Biotechnology and medicine

- Real Estate and Construction

- Oil and gas industry

- Household products

- Activity of mobile operators

- The scope of state and government institutions

- New technologies

- Electricity and fuel and energy complex

- Finance

-

ServicesBack

- Offshore company registration

- Tax consulting services

- Licensing

- Open a bank account

- Opening an account in the payment system

- FinTech Services

- Forex Broker License

- Gambling

- Accounting services

- Corporate services

- IT Law

- Due diligence

- Registration of trademarks

- Advocate

- Fintech Software Development

- Support IPO

- ICO consulting services

- Citizenship in Ukraine

- Opening merchant account

- Drafting contracts

- Redomicile of companies

- Trust registration

- Investment

- Investment in real estate

- Legal Opinion

- Opening a cryptocurrency debit card

- International business certification

- Businesses for sale

- Prices

- Contacts

- News

Zurich

+41 435 50 73 23Kyiv

+38 094 712 03 54London

+44 203 868 34 37Tallinn

+372 880 41 85Vilnius

+370 52 11 14 32New York

+1 (888) 647 05 40